at what age can you get a credit card in singapore

At least 30000 if youre. You will have to hit a minimum spend of S600 in a month to redeem the possible cashback.

How Many Credit Cards Should Singaporeans Own

However if your parent or legal guardian will co-sign the account you can.

. However getting a credit card at 18 can also be difficult because young adults under 21 must meet. Minimum gross annual income of S30k if you are a Singaporean or S45k if you. This co-branded card is the first online shopping card in Singapore specially designed for students.

Here is a list of our partners and heres how we make money. Singapore Citizens and Permanent Residents aged 21 and above with a minimum. You need to be at least 18 years old to apply for your own credit card.

They take your gross annual income into consideration too. If youre an avid Qoo10 shopper you may have come across this card. By using a credit card you can divide that big purchase into smaller payments over a certain.

You have to be at least 18 years old to apply for a credit card in the US but if youre under 21 it may be difficult. First things first if youre applying to be the main cardholder you need to be at least 21 years old. You can get a credit card in your own name at.

For Individuals above 55 Years Old. For Singaporean and Permanent Residents most credit card issuers will require a minimum income of S30000. The Best Card for You Is a Credit.

However for foreigners it is usually at. Annual income of at least S15000. If youre planning to make a big purchase a credit card may be your best option.

In terms of perks this card is also at an advantage as it has. If youre 18 and you decide to apply for this student credit card youll be able to use it for at least another 12 years. There is also a minimum age limit requirement of 18 years old with parents consent or 21 years old without which also means that the privilege of holding a credit card is.

You have to be at least 18 years old to get a credit card in your own name or as the primary cardholder. Up to 4 months of. Up to 2 months of income.

What is the eligibility for Credit Card Application Principal Credit Card You need to be 21 to 70 years of age. FIs can issue credit cards to individuals above 55 years old if they meet one of these criteria. In fact getting a credit card and using it responsibly can be an effective way for starting off your credit journey on the right foot.

Prior to Dec 2013 individuals above 55 years old needed to have annual incomes of at least S15000 to qualify for credit cards. However this requirement posed difficulties for retirees. Today you must be 21 years of age to get a credit card in your own name unless you have a cosigner or can show proof of steady income.

Here are the regulatory limits for individuals up to 55 years of age.

The New Live Credit Card Campaign Dartslive Singapore Facebook

Crazy Uses For Old Credit Cards Enjoycompare

Secured Credit Cards This Is How Students And Retirees Can Get A Credit Card Without An Annual Income

6 Best Credit Card Petrol In Singapore 2022 Funempire

Should I Get A Credit Card In Singapore

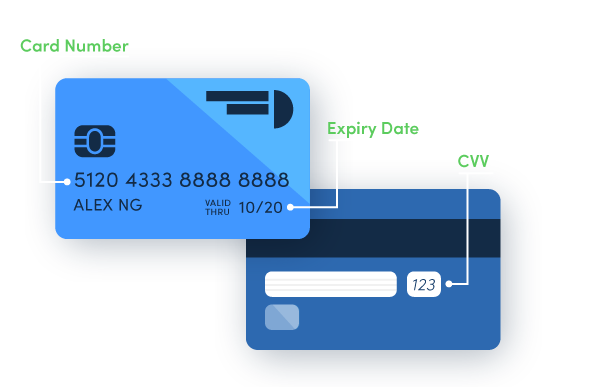

The Ultimate Guide To Credit Card Application In Sg

The Noob Af Guide How To Apply For Credit Cards In Singapore

Can A Ten Year Old Get A Debit Card Or Credit Card How Kids Can Earn Money

When Is The Right Time To Apply For A Credit Card In Singapore

Guide To Applying For A Singapore Credit Card Moneysmart Sg

Singapore Share Credit Card Holder 2017 Statista

How To Apply For Credit Cards In Singapore The Complete Guide

Which Miles Credit Card To Use In Singapore 2022 Best Prices In Singapore

Ocbc Credit Cards Cashback Rewards Miles More Benefits

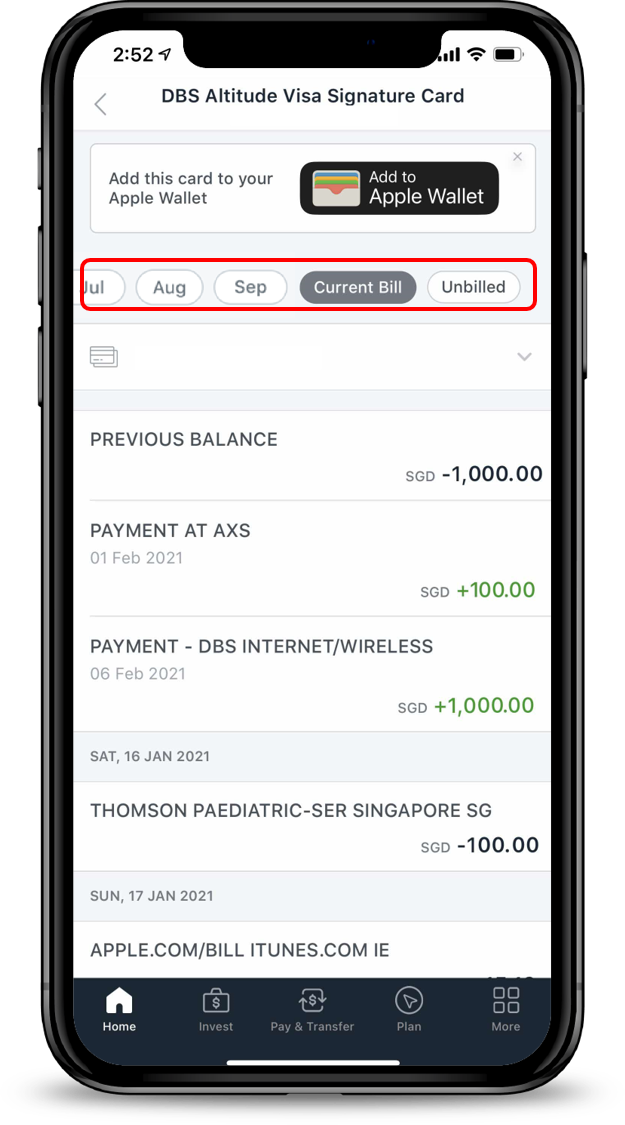

Check Credit Card Transaction Details Dbs Singapore

The Noob Af Guide How To Apply For Credit Cards In Singapore

Instarem Amaze Card Features Benefits How To Apply

Increase Your Chances Of Getting A Credit Card Moneyduck Singapore